Although this procedure may vary from bank to bank, the fundamentals are essentially the same throughout all Nigerian banks located across the country.

Do you recall the time you were forced to go home quickly to get your ATM card because you feared you would need it in the market? Never once more

For banks, providing quick and easy banking is the new strategy for reaching clients, particularly younger ones. We examine how to use a cardless ATM withdrawal from Citibank in this post.

The nation’s top international bank, Citibank, is committed to innovation in order to improve its clients’ banking experiences. All Citibank ATMs now allow debit account withdrawals without using a card.

If you forget your Citibank Debit Card and need money right away, you don’t have to go to a branch and make time-consuming over-the-counter transactions.

You may easily set up a cardless cash withdrawal using the capability in Citibank Online or the Citi Mobile App by using a One-Time PIN (OTP) that is issued to you through SMS.

Then, make your way to the closest Citibank ATM, where you will be given a second OTP that you must enter in order to withdraw money. This new Citibank ATM function is cost-free and may reduce fraud and ATM skimming.

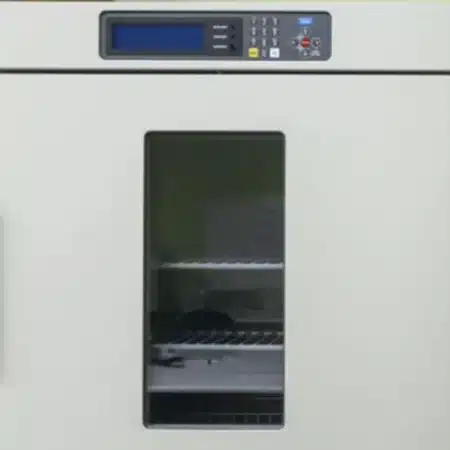

Cardless Atm

You may be able to access your account at a cardless ATM without inserting a standard debit card by using a contactless card or a mobile banking app.

You could turn back the next time and insert your card if you wanted to since the ATM itself is the same ATM. Only the manner in which you begin your transaction differs “Ken Justice, senior vice president, and executive in charge of PNC Bank’s ATMs, adds.

Cardless ATMs are secure to use yet still need authentication. Either your PIN, a code, or a combination of the two will be required.

According to Justice, “it’s a convenience feature that we believe is really safer from the perspective that you prevent any chance for card skimming.”

The only thing to remember is to keep an eye out for card skimming, which may happen at an ATM or a point-of-sale transaction. When you swipe or put your card into a machine, someone may try to steal your personal information via card skimming.

Because you’re using a contactless card or the mobile app for your bank, you may be able to prevent card skimming while making a cardless purchase.

When a one-time password is generated, certain financial institutions, including PNC Bank, will additionally contact the user. In case it wasn’t you performing the transaction, you may swiftly get in touch with a financial institution in this method.

What is CitiBank

The consumer arm of financial services giant Citigroup is called Citibank. As the City Bank of New York, Citibank was established in 1812 and subsequently changed its name to First National City Bank of New York. Credit cards, mortgages, personal loans, business loans, and lines of credit are all offered by Citibank.

What Do I Need to Make a Cardless ATM Withdrawal?

- A phone with your registered line in it

- Your bank’s USSD code or Mobile Banking App

- Little airtime (not in all cases)

- Internet

- ATM Card

- Withdrawal slip

NOTE THAT: The cardless cash ATM withdrawal process is roughly similar to EVERY bank that offers this service.

Step-by-Step Process: Cardless ATM Withdrawals

First, you must be on the same line you receive your bank alerts on i.e, your registered line.

- Dial your bank’s USSD code or use the Mobile Bank App

- You will see a menu. Choose the Cardless Withdrawal Option

- Enter the amount, and submit

- A code called OTP (One-Time Password) will be sent to your registered line

- Enter your secret PIN and password.

- Proceed to your bank’s ATM stand to withdraw

How to Withdraw from Citi bank without an ATM Card

As previously said, although these phases may vary from bank to bank, they all follow a similar procedure. For this reason, I have created a short tutorial on how to make cardless cash withdrawals from Citibank.

The number of cash transactions is declining in the digital era, so you may not think about having fast and easy access to cash very frequently. But it’s useful to have when you need it.

With cardless ATMs, you may use the bank app on your smartphone to conduct ATM transactions. They’re a practical method to get money from your bank account if you forget your debit card or would like to touch an ATM’s screen as little as possible.

What are cardless ATMs and how do they work?

Cardless ATMs provide you access to your account and let you make cash withdrawals without a card. Instead, they depend on text message account verification or a smartphone banking app.

Cardless ATMs have a number of different ways they might operate. Quick response (QR) codes, near-field communication (NFC), verification codes, and biometric verification are examples of cardless technology types.

A QR Code

You must first enable mobile withdrawal on your banking app in order to utilize a cardless ATM with a QR code. Before the money is dispensed, the ATM will then show a QR code on the screen for you to scan with your phone.

Close-range communication (NFC)

NFC, or near-field communication, technology is used by several applications like Apple Pay. Open the app on your mobile device, choose the associated bank account you wish to withdraw from, and then touch your phone against the relevant reader to utilize NFC at a cardless ATM. The ATM will request that you enter your PIN in order to complete the transaction (just as if you had inserted your card).

Conclusion:

“Citibank ATMs now automatically provide information based on client choices and let users check their balances.

With cardless ATMs, you may use the bank app on your smartphone to conduct ATM transactions. They make it simple to withdraw money from your bank account. You can do it right now without any assistance.